Fundamentals of Security Markets

INTRODUCTION

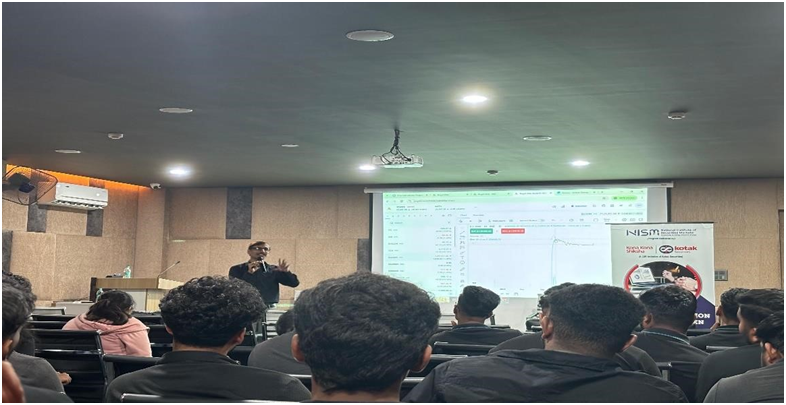

As part of the academic enrichment initiative, the Department of MBA at St. Philomena’s College (Autonomous), Mysore, organized a three-day workshop titled “Fundamentals of Securities Market” from 7th to 9th July 2025. The objective of this workshop was to provide students with a practical understanding of the Indian securities market, its components, and career prospects in the financial sector.

The sessions were conducted by Dr. Shivakumar, a certified trainer associated with SEBI, NSE, and NISM, who brought valuable industry knowledge and live demonstrations to the classroom. The workshop covered various key areas including the structure and functioning of the stock market, live trading operations, mutual funds, and emerging career opportunities in investment and financial services.

This report aims to document the learning’s and key takeaways from the three days workshop, reflecting the blend of theoretical concepts and practical exposure that it offered.

Workshop Report –Day 1

Session Summary

The first day of the three-day workshop began with an inspiring and insightful session led by Dr. Shivakumar, an accomplished finance professional and academic with over 17 years of experience in both industry and education.

Serving as Program Coordinator at

Visvesvaraya Technological University (VTU), Mysore, and a certified trainer for SEBI, NSE, and NISM, Dr. Shivakumar set the tone for the workshop with his deep expertise in securities markets and behavioural finance.

The session commenced with a formal welcome and introduction, highlighting his extensive qualifications including a Ph.D. in Finance, M.Com in Marketing, and an MBA in Finance & Marketing. Participants were especially intrigued by his journey—from a Research Analyst at Thomson Reuters to a nationally recognized resource person with certifications from NISM, NSE, and SEBI.

Key Highlights

- Overview of financial markets and their structure

- Introduction to investment analysis with real-life examples

- Insights into behavioural finance and investor psychology

- Emphasis on the role of regulatory bodies (SEBI, NSE, NISM) in market governance

- Interactive Q&A session encouraging analytical thinking and practical application

Topics Covered 1.Investment in Stocks

- Definition and role of stocks in capital markets

- How stock ownership represents partial ownership in a company

- Importance of Demat and trading accounts for investing

- Steps to begin investing: selecting brokers, researching companies, placing orders

- Types of stocks: blue-chip, mid-cap, small-cap, and their risk-return profiles

Opportunities of Investment

- Overview of major investment avenues: stocks, mutual funds, bonds, ETFs, and IPOs

- Sectoral opportunities in India: technology, renewable energy, infrastructure, and consumer goods2

- Long-term wealth creation through value investing and portfolio diversification

- Role of behavioural finance in identifying undervalued opportunities

Main Rules of Investment in Stocks

- Rule 1: Never invest without understanding the business4

- Rule 2: Avoid herd mentality—make independent, informed decisions

- Rule 3: Diversify your portfolio to manage risk7

- Rule 4: Focus on long-term goals rather than short-term market timing

- Rule 5: Invest only surplus funds you can afford to risk

- Rule 6: Monitor your investments regularly and stay updated with market trends

- Rule 7: Be disciplined and avoid emotional decision-making during volatility

Learning Outcomes

- Participants gained clarity on how to begin investing in stocks confidently

- Understood the importance of research, patience, and strategy in financial decision-making

- Recognized the wide range of investment opportunities available in

India’s evolving market landscape

- Learned practical rules and thumb strategies to guide their investment journey

Participant Engagement

Participants actively engaged with the session through thoughtful questions and case discussions. The use of real-world scenarios, diagrams, and financial data interpretation made the session highly relatable and useful for students and professionals alike.

Workshop Report –Day 2

Primary Market

- The primary market is the market where new securities (shares, bonds, debentures) are issued and sold for the first time.

- It is also called the new issue market (NIM).

- In this market, companies, governments, or institutions raise fresh capital by issuing new securities directly to investors.

Investment in Primary Market

Investors can invest in the primary market through various methods:

Public Issue (IPO/FPO):

A company invites the general public to subscribe to its shares through an Initial Public Offering (IPO) or Follow on Public Offering (FPO).

+

2. Private Placement:

Securities are sold directly to a select group of investors such as institutional investors, banks, or mutual funds.

3. Rights Issue:

Existing shareholders are given the right to purchase additional shares at a discounted price within a specific time.

4. Preferential Allotment:

Shares are issued to a small group of investors, often promoters or strategic investors, at a predetermined price.

Process of Investing in the Primary Market

- Issue Announcement:

The company announces the new issue through a prospectus.

- Application:

Investors fill out an application form and submit it along with the payment.

- Allotment of Securities:

If the issue is oversubscribed, shares are allotted on a proportionate basis or by lottery.

- Listing:

Once the issue is complete, the securities are listed on the stock exchange for trading in the secondary market.

Advantages of Investing in the Primary Market

- Opportunity to invest at the issue price, which can be lower than the market price.

- Helps diversify portfolio with new securities.

- Contributes to the capital formation of the economy.

Risks in Primary Market Investment

- Possibility of overpricing.

- No track record for new companies.

- Allotment risk (may not get full quantity of shares applied for)

Capital Insurance:

Capital Insurance is not a standard term like “life insurance” or “health insurance.” Instead, it generally refers to mechanisms or models used to protect an investors or institution’s capital against significant losses.

It combines investment with protection, ensuring that even if market conditions are unfavorable, a certain amount of capital is preserved.

Model of capital insurance

- Protect principal investment (full or partial)

- Allow some market participation (so you still benefit if the market performs well)

- Use insurance mechanisms or financial derivatives to manage downside risk.

IPO stands for Initial Public Offering.

It is the process by which a private company offers its shares to the public for the first time and becomes a publicly listed company on a stock exchange.

Why Do Companies Go for an IPO?

- To raise fresh capital for expansion, projects, or debt repayment.

- To gain public visibility and credibility.

- To provide an exit route for early investors or promoters.

OST Insurance

Post insurance typically refers to the period after an insurance policy has been issued or renewed. During this phase, the policyholder is covered for the risks specified in the policy, and the insurance company is liable to pay for covered losses or damages.

- Claims Processing: The process of filing and settling claims when a covered event occurs.

- Policy Management: Managing the policy, including updates, renewals, and cancellations.

- Customer Support: Providing assistance and support to policyholders as needed.

Importance of Due Diligence

Due diligence is the process of thoroughly investigating and evaluating a business or investment opportunity before making a decision. Its importance includes:

- Risk Assessment: Helps identify potential risks and liabilities.

- Informed Decision Making: Provides a comprehensive understanding of the opportunity, enabling better decision making.

- Protection: Protects investors and stakeholders by uncovering any red flags or issues.

Offer Document Information

An offer document is a legal document issued by a company to potential investors when it wants to raise capital through public offerings of shares or other securities.

Components:

- Financial Information: Details about the company’s financial health, including balance sheets and profit and loss statements.

- Business Overview: Information about the company’s business model, management, and future prospects.

- Risk Factors: Disclosure of potential risks associated with investing in the company.

Price Discovery Shares

Price discovery is the process of determining the price of a security (such as shares) in the market through the interaction of buyers and sellers.

- Market Forces: Prices are determined by supply and demand dynamics in the market.

- Efficient Markets: In efficient markets, prices reflect all available information, leading to fair valuations.

- Investor Sentiment: Price discovery can be influenced by investor perceptions, news, and market trends.

Share Allotment Process

The share allotment process refers to the procedure by which a company allocates shares to applicants during an initial public offering (IPO) or other share issuance.

- Application: Investors apply for shares by submitting their applications along with payment.

- Allotment: The company allocates shares based on the application details and availability.

- Refund: Any excess application money is refunded to unsuccessful or partially successful applicants.

Share Allotment Status

Share allotment status refers to the current state of an investor’s application for shares in an IPO or other share issuance.

- Online: Through the registrar’s website or the company’s portal.

- Application Status: Whether the application is pending, successful, or rejected.

- Allotment Details: Information about the number of shares allotted and any refund due.

Investment in Secondary Market

Investment in the secondary market involves buying and selling securities (such as stocks and bonds) that are already issued and outstanding.

Features include:

- Liquidity: Securities can be easily bought and sold on stock exchanges.

- Price Fluctuations: Prices are determined by market forces and can fluctuate based on supply and demand.

- No Direct Funding: The proceeds from secondary market transactions go to the seller, not the issuing company.

Trading in Secondary Market

Trading in the secondary market refers to the buying and selling of securities among investors.

- Stock Exchanges: Trading occurs on organized exchanges like the NSE or BSE.

- Brokerage: Investors typically use brokers or trading platforms to execute trades.

- Market Hours: Trading occurs during specific market hours, and prices can be influenced by real time market dynamics.

Workshop Report –Day 3

Session Summary

The third and final day of the workshop focused on the Mutual Fund industry and its growing relevance in today’s financial landscape. The session was conducted by Dr. Shivakumar, who combined theoretical concepts with realtime practical demonstrations using mutual fund websites. The session aimed to create awareness among students about how mutual funds operate and how they can be a reliable tool for personal financial growth and career opportunities in the financial sector.

Key Highlights

- Real-time demonstration of mutual fund platforms

- Introduction to Systematic Investment Plans (SIPs)

- Explained fund types: equity, debt, hybrid, ELSS, and index funds

- Step-by-step explanation of how to compare and choose funds

- Discussion on how beginners can start investing with small amounts

- Insights into career roles in mutual fund and investment sectors

Topics Covered

- Meaning and Structure of Mutual Funds

- Types of Mutual Funds (Equity, Debt, Hybrid, Index, ELSS)

- Role of Asset Management Companies (AMCs)

- How SIPs work and their benefits

- Live navigation of mutual fund websites (e.g., AMFI, Moneycontrol, Groww)

- Career opportunities in investment and financial services

Learning Outcomes

- Gained a clear understanding of how mutual funds work

- Learned to differentiate between types of mutual funds and their riskreturn profiles

- Developed basic skills in using online mutual fund tools and platforms

- Understood the importance of early investment and long-term financial planning

- Became aware of potential career paths in the mutual fund and financial services industry

Conclusion

The three-day workshop on “Fundamentals of Securities Market”, organized by the MBA Department of St. Philomena’s College, Mysore, was an insightful and impactful learning experience. Each day focused on a different core aspect of the financial market—from understanding the basic structure of the securities market, to exploring real-time stock trading operations, and finally, diving into the world of mutual funds and investment opportunities.

The sessions conducted by Dr. Shivakumar, an expert trainer associated with SEBI, NSE, and NISM, were both informative and engaging. His ability to combine theoretical knowledge with live demonstrations gave students a clear and practical understanding of how financial markets function in real life. This workshop not only enhanced our academic understanding but also encouraged us to explore personal investment strategies and consider career prospects in the growing field of finance and investment services. It has laid a strong foundation for financial literacy and professional growth. Overall, the workshop was a valuable initiative that contributed meaningfully to our academic and professional development.

![WhatsApp_Image_2026-02-28_at_3.29.30_PM[1]](https://stphilos.ac.in/wp-content/uploads/2026/02/WhatsApp_Image_2026-02-28_at_3.29.30_PM1-300x200.jpeg)