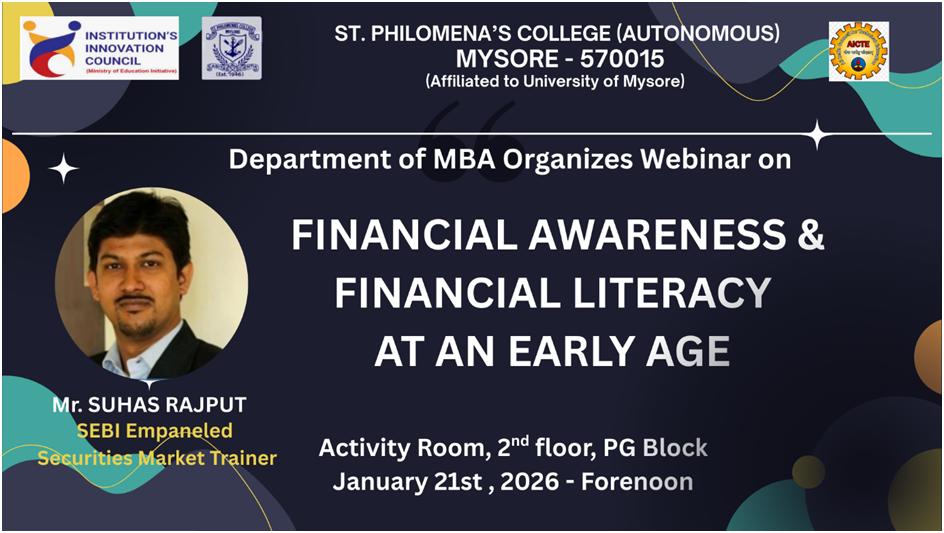

Financial Awareness and Financial Literacy at an Early Age

Webinar titled “Financial Awareness and Financial Literacy at an Early Age” was organized by Department of MBA for I year MBA students with the objective of educating them about the fundamentals of financial markets, investment planning, and investor protection mechanisms.The initiative was undertaken by Mr.Suhas Rajput to bring on board Mr.VenkateshBabu, Assistant Manager at SEBI, and Ms.AnshuKumari, Manager at the National Stock Exchange (NSE) of India, as distinguished resource persons.

The webinar aimed to bridge the gap between theoretical knowledge and practical financial decision-making by providing participants with insights into securities markets, regulatory frameworks, and responsible investing practices. The program was designed to help students develop a strong foundation for making informed, ethical, and risk-aware financial decisions at an early stage of life.

The webinar was structured into two comprehensive sessions, each conducted by a distinguished resource person. While the first session focused on SEBI awareness and investor education, the second session emphasized practical financial literacy and investor awareness from an investor’s perspective.

Resource Persons

The webinar featured the following expert speakers:

- Mr.VenkateshBabuMR- Assistant Manager at SEBI – Resource Person for the First Session

- Ms.AnshuKumari – Manager, National Stock Exchange (NSE) of India – Resource Person for the Second Session

Both speakers brought extensive professional experience and practical insights, making the sessions informative and engaging for the participants.

Session I: SEBI Awareness and Investor Education

The first session was conducted by Mr.VenkateshBabuMR who focused on creating awareness about the role and importance of the Securities and Exchange Board of India (SEBI) in the Indian financial system. The session began with an introduction to SEBI, highlighting its establishment on April 12, 1992, and its primary objectives of protecting investor interests, regulating the securities market, and ensuring its orderly development.

Mr.Babu provided a detailed overview of the structure of the securities market, explaining the roles of various key participants such as investors, stock exchanges, intermediaries, and regulatory authorities. He clearly distinguished between the primary market and the secondary market, helping students understand how securities are issued and subsequently traded.

The session also emphasized the importance of investment due diligence, including the procedures involved in participating in public issues. Participants were educated about the advantages of investing, such as wealth creation and financial security, as well as the rights of shareholders as part-owners of a company, along with the limitations associated with those rights.

In addition, the following important topics were discussed in detail:

- Concept and significance of mutual funds, their benefits, and their suitability for different types of investors

- Systematic Investment Plans (SIPs) as a disciplined and long-term investment strategy

- Various investor protection measures introduced by SEBI

- The Investor Charter, outlining essential dos and don’ts for investors

- Ethical guidelines for selling shares while maintaining market integrity

The session concluded with practical guidance on using SEBI’s official resources, including the SEBI website, the SEBI Saathi App, and the SEBI toll-free helpline for addressing investor grievances. Overall, the session equipped participants with regulatory knowledge and practical tools to navigate the securities market safely and responsibly.

Session II: NSE Financial Literacy and Investor Awareness

The second session was conducted by Ms.AnshuKumari, Manager at the National Stock Exchange (NSE) of India. This session focused on enhancing financial literacy by explaining financial concepts from an investor’s practical perspective.

The session began with a discussion on money, income, savings, and investment, clearly differentiating between savings and investments while highlighting their respective advantages and limitations. Ms.Kumari explained the concepts of active income and passive income, emphasizing the importance of building passive income streams to ensure long-term financial stability and independence.

A key highlight of the session was the explanation of inflation and its impact on purchasing power. Through a graphical illustration, participants were shown how the cost of living increases over time while the real value of money declines, reinforcing the necessity of investing rather than merely saving.

The session further covered:

- A comparative analysis of various investment products available in the market

- The importance of choosing a SEBI-registered stockbroker and avoiding unregistered or fraudulent intermediaries

- Understanding market indices and the impact of market corrections on investor portfolios

- Portfolio return calculation and the power of compounding, demonstrated using an example of investing ₹30,000 per month at an annual return of 12%

- Awareness videos on common financial scams, including double return schemes, fake trading applications, and fraudulent advisory services

- Nine commonly used scammer tactics and practical tips for investor protection

- Information on online bond platforms and Common Investor Service Centres (CISC) for investor support and grievance redressed.

This session effectively combined conceptual clarity with real-life examples, enabling participants to understand both opportunities and risks associated with financial markets.

The webinar on “Financial Awareness and Financial Literacy at an Early Age” provided comprehensive and structured exposure to essential financial concepts, regulatory frameworks, and practical investment strategies. Participants gained valuable insights into the role of SEBI, the functioning of securities markets, investor rights and responsibilities, and methods to safeguard themselves against financial fraud.

The sessions emphasized the critical importance of developing financial literacy at an early age and encouraged students to adopt informed, disciplined, and responsible investment practices. Overall, the webinar was interactive, engaging, and highly beneficial, empowering students with the knowledge and confidence required to navigate financial markets safely and make sound financial decisions in the future.