Money Mangement

Introduction –

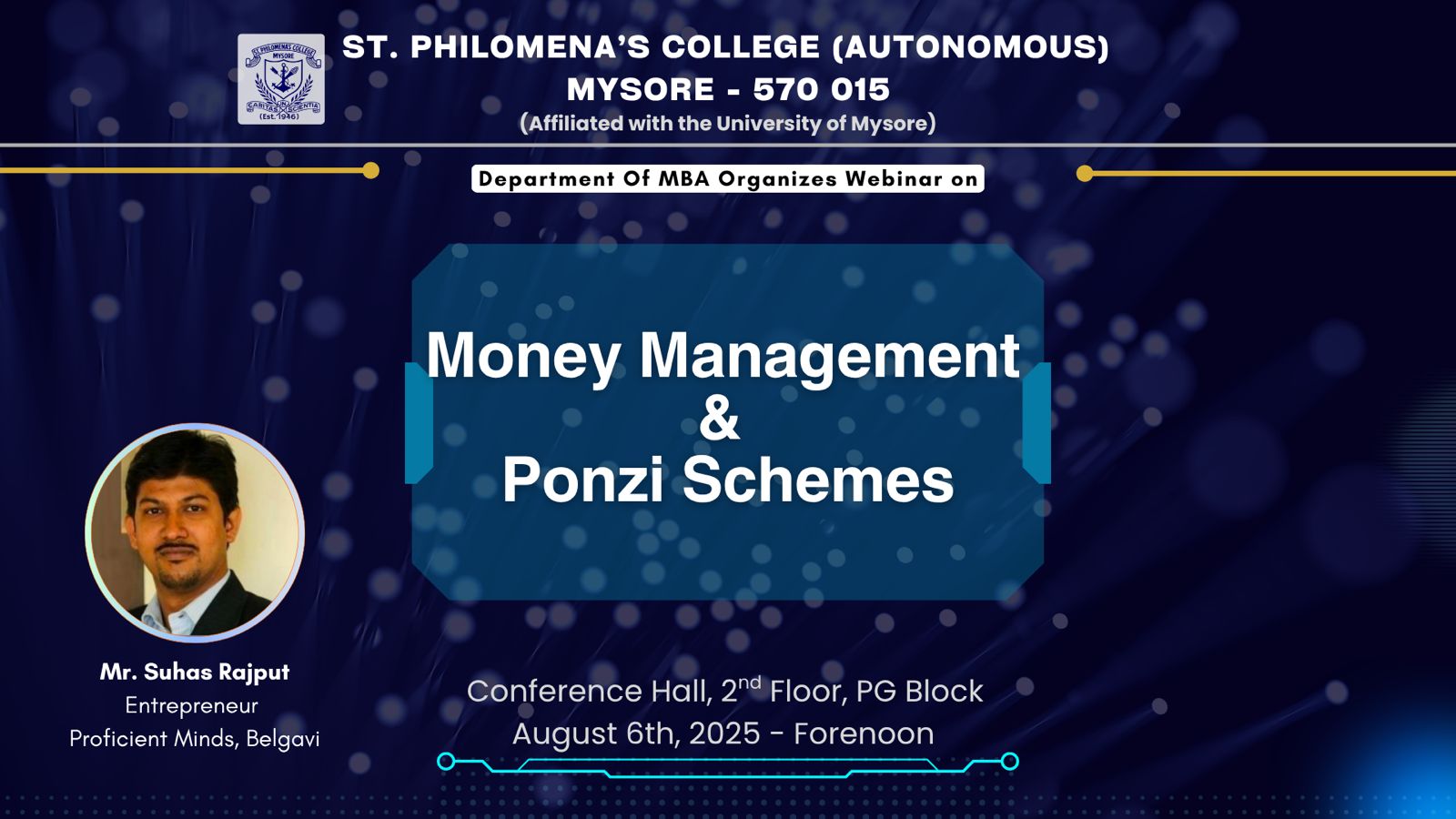

A Webinar on Money Management and Ponzi Schemes was held on 6th August 2025 at the Conference Hall, 2nd Floor, PG Block. The session, hosted by Mr. Suhas Rajput, an entrepreneur from Proficient Minds, Belagavi, was attended by students, faculty members, and staff. It was held at 11.30 am which was one hour session.

Mr. Rajput began by highlighting the importance of cultivating sound money management skills, including budgeting, saving, and prudent investing with help of two videos. He stressed the need for financial literacy in the present age of digital transactions and online investment platforms. It was followed by elaborated explanation about the risk–reward concept, emphasizing that every investment carries a certain degree of risk, and higher potential returns are generally associated with higher risks. He explained that in legitimate investment avenues, returns are proportionate to the level of risk involved and are realized over time, not instantly. Using simple analogies and market-based examples, he demonstrated how investors must assess their own risk tolerance before committing funds.

Money management and Ponzi schemes

Money management is the process of budgeting, saving, investing, spending, and overseeing the capital usage of an individual or an organization. For individuals, it’s about ensuring day-to-day financial stability while working towards long-term wealth creation. For businesses, it involves cash flow management, investment decisions, and financial risk control.

The prime objectives are

Ensure Liquidity: Maintain enough cash or liquid assets to meet immediate needs.

Maximize Returns: Allocate funds in ways that grow wealth.

Minimize Risks: Use insurance, diversification, and prudent investments to reduce uncertainty.

Achieve Goals: Such as buying a home, funding education, or retiring comfortably.

Control Spending: Avoid overspending and debt traps.

Principles of Effective Money Management

Live Below Your Means: Spend less than you earn.

Pay Yourself First: Prioritize savings before discretionary spending.

Diversify Investments: Avoid putting all your money in one asset.

Track Your Finances: Monitor cash inflows and outflows regularly.

Plan for Taxes: Optimize savings and investments for tax efficiency.

Common Mistakes to Avoid

Overspending on wants instead of needs.

Not having an emergency fund.

Relying too much on credit.

Ignoring inflation when planning long-term goals.

Delaying investment decisions.

Ponzi Schemes

Schemes that promise extremely high returns in a very short time are often a red flag for investment fraud, as they typically ignore the fundamental risk-return relationship. It is the principle that higher returns generally come with higher risks. When an investment claims to deliver “guaranteed” profits far above market rates without clear, legitimate business activity, it often relies on unsustainable or deceptive practices. These schemes prey on greed and urgency, using attractive promises to lure investors who may overlook due diligence. Such opportunities are inherently risky because they either involve highly speculative ventures or are outright fraudulent.

A Ponzi scheme is a classic example of such fraud. Named after Charles Ponzi, who became infamous for this practice in the early 20th century, it is an investment scam where returns to earlier investors are paid using the capital of newer investors, rather than from legitimate business profits. The scheme relies on a continuous influx of new funds to survive; once recruitment slows, the operation collapses, leaving most participants with heavy losses. The illusion of profitability is maintained by showing consistent returns, often in line with the promises made, which persuades existing investors to reinvest and new investors to join.

The objective of a Ponzi scheme from the perpetrator’s perspective is purely to enrich themselves by exploiting trust, greed, and the lack of financial awareness among participants. The principles behind its operation include creating an aura of exclusivity, offering above-average “guaranteed” returns, and using early payouts as proof of legitimacy. This builds investor confidence and fuels word-of-mouth promotion. However, unlike a legitimate business that generates profit through productive activity, Ponzi schemes produce no real value — they only redistribute money from new investors to old ones, making eventual collapse inevitable.

Common mistakes investors make in falling for such schemes include failing to verify the business model, ignoring the lack of transparency in operations, trusting verbal assurances over documented proof, and being swayed by testimonials without verifying their authenticity. Many are also blinded by “fear of missing out” (FOMO) and fail to question how such high returns are possible without proportional risk. Ultimately, understanding that genuine investments take time to yield reasonable returns is crucial. If an opportunity sounds too good to be true, it usually is and the cost of ignoring this reality can be financial ruin.

Conclusion

The webinarmainly focused on Ponzi schemes, explaining how such fraudulent setups promise unusually high returns often doubling money in a short duration to lure investors. Using real-life examples, Mr. Rajput detailed the typical warning signs of such scams, such as unrealistic guarantees, lack of transparency, and pressure to reinvest earnings.He warned that schemes promising extremely high returns in a very short period are inherently risky and often fraudulent, as they bypass the natural balance between risk and reward that underpins genuine financial markets.

He advised the students, to be cautious and conduct thorough research before committing funds to any investment opportunity. His key message was clear: “If it sounds too good to be true, it probably is.” The session concluded with an interactive Q&A, where participants clarified doubts about legitimate investment avenues and safeguarding themselves from financial frauds.

![WhatsApp_Image_2026-02-28_at_3.29.30_PM[1]](https://stphilos.ac.in/wp-content/uploads/2026/02/WhatsApp_Image_2026-02-28_at_3.29.30_PM1-300x200.jpeg)